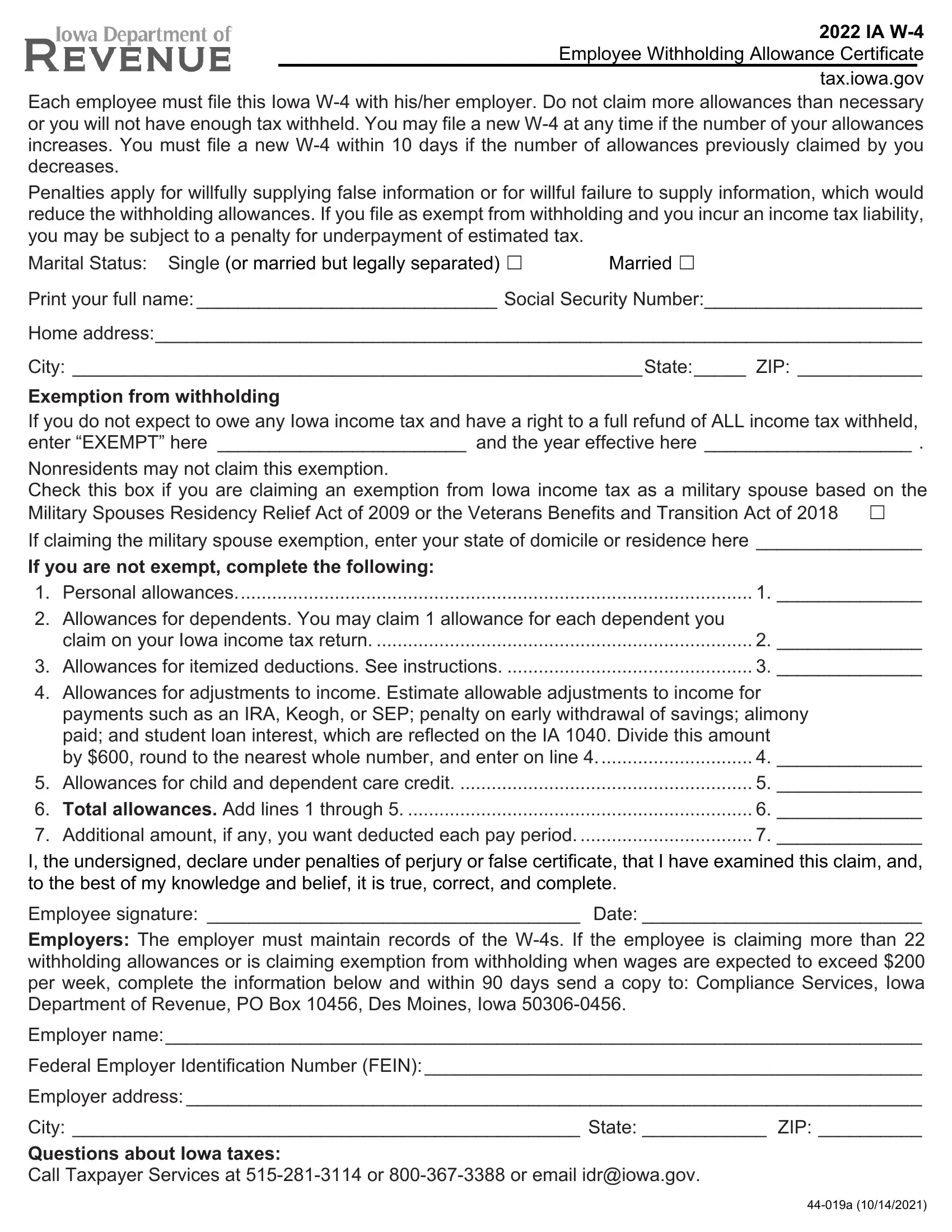

2025 Iowa W-4. There will be two brackets in 2025 with a top rate of 4.82 percent and a single. First, in a multiyear plan.

In both 2024 and 2025, the highest rate will be eliminated, so in 2026 iowa will have a single rate possibly necessitating future adjustments. Do not claim more allowances.

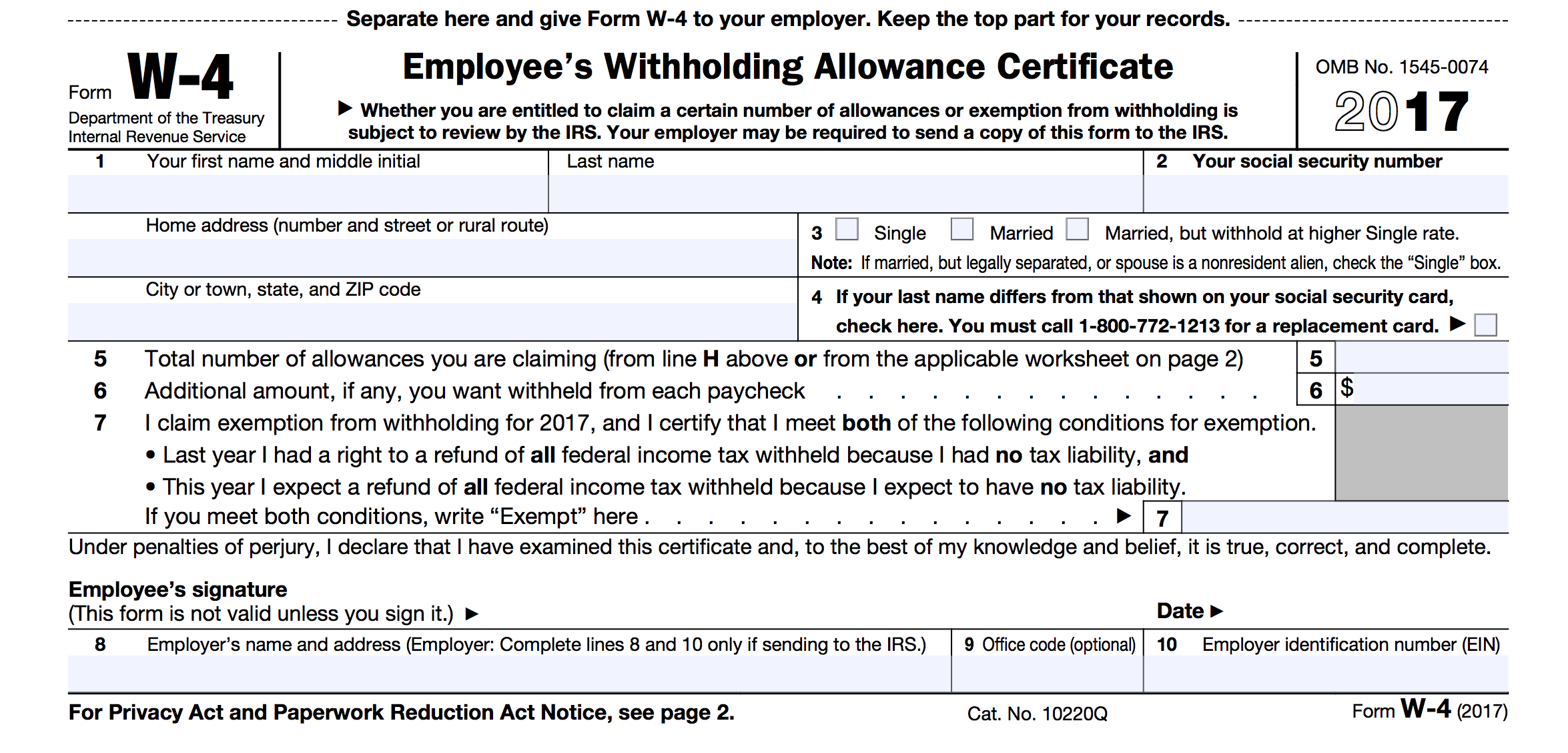

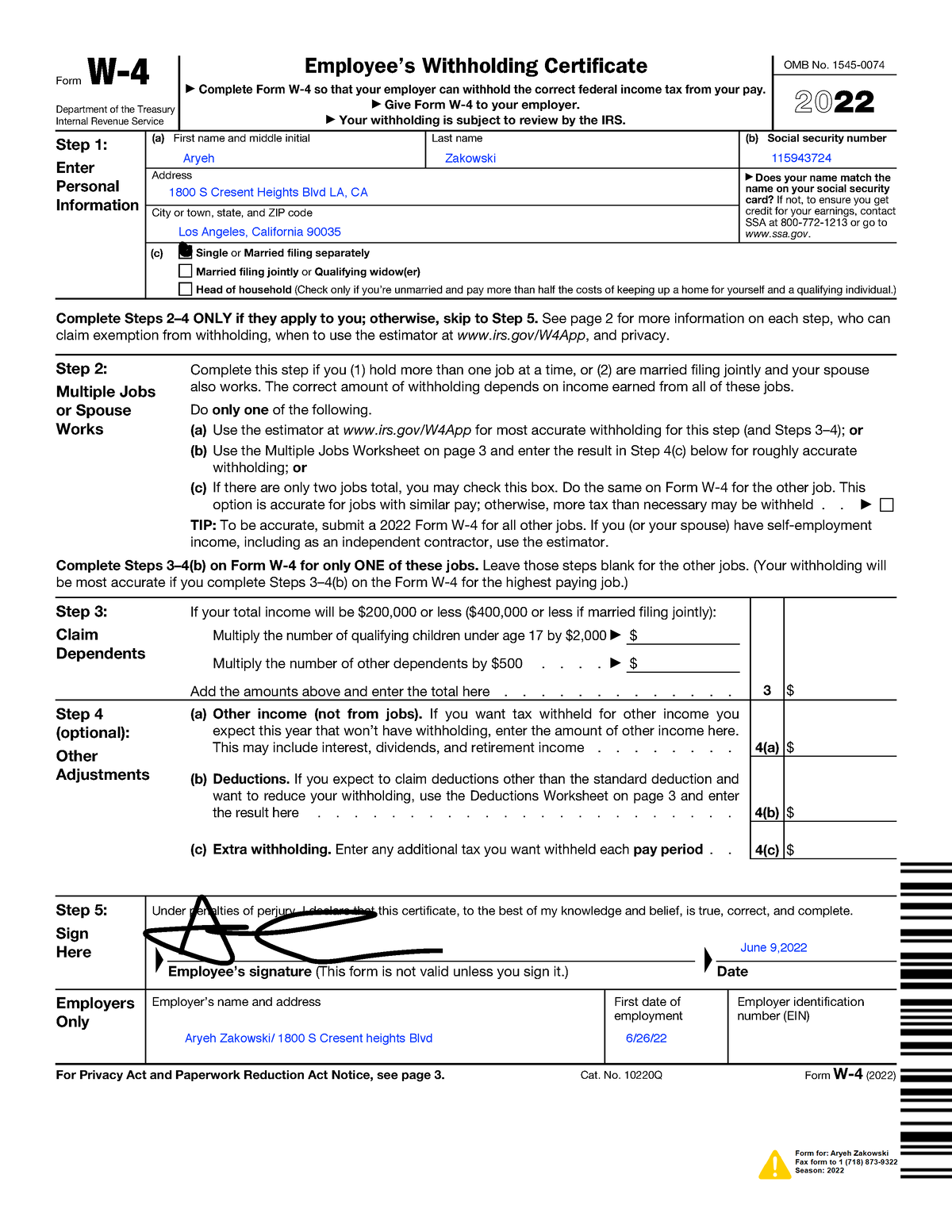

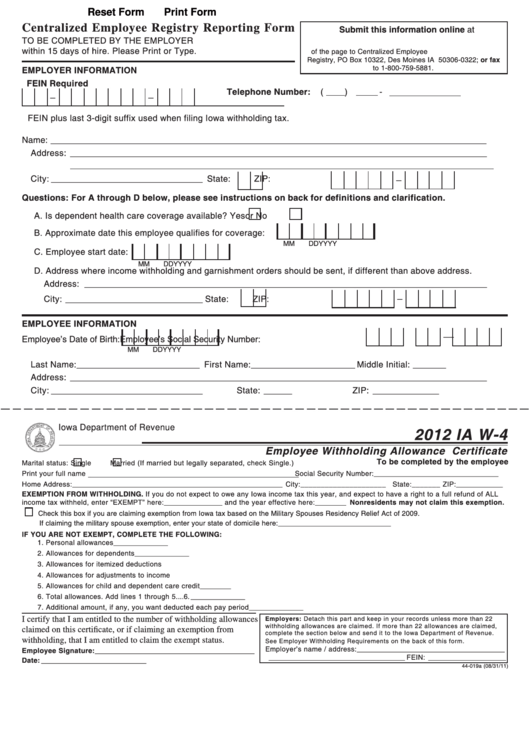

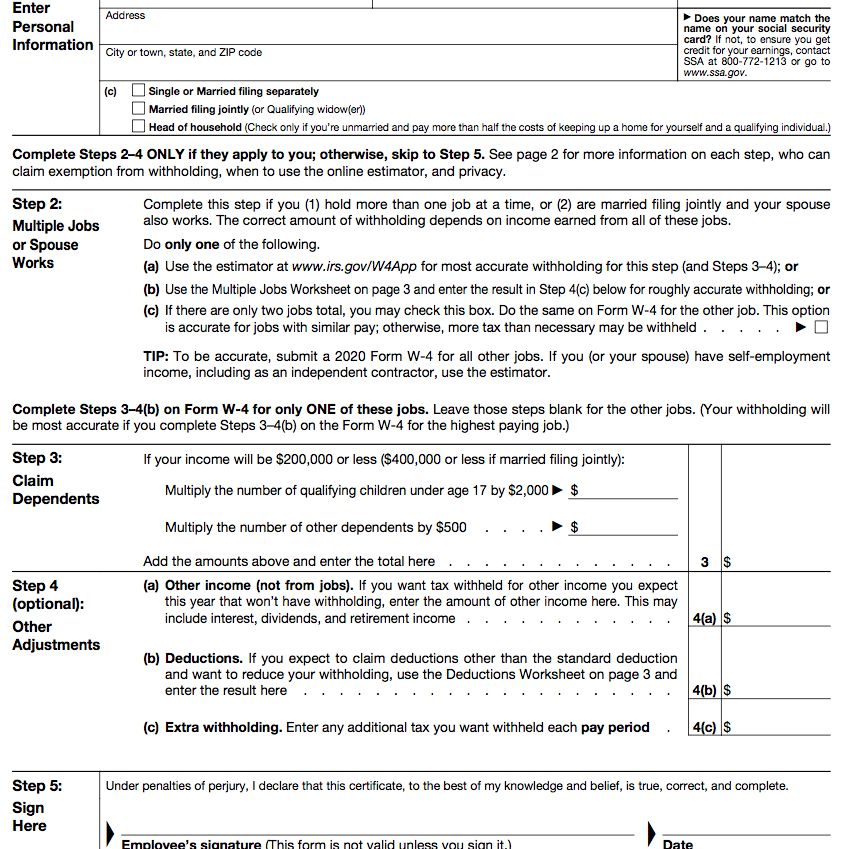

When You Start Working You Will Need To Fill Out A Form To Set The Amount Of Taxes That Will Be Taken Out Of Your Check Each Payday.

The new form has updated the filing status and now.

First, In A Multiyear Plan.

Centralized payroll is committed to meeting the expectations of state of iowa employees each pay period to receive a timely and accurate payment.

2025 Iowa W-4 Images References :

Source: denicebkarlene.pages.dev

Source: denicebkarlene.pages.dev

W4 Form 2025 Ora Mellisent, There will be two brackets in 2025 with a top rate of 4.82 percent and a single. All publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form.

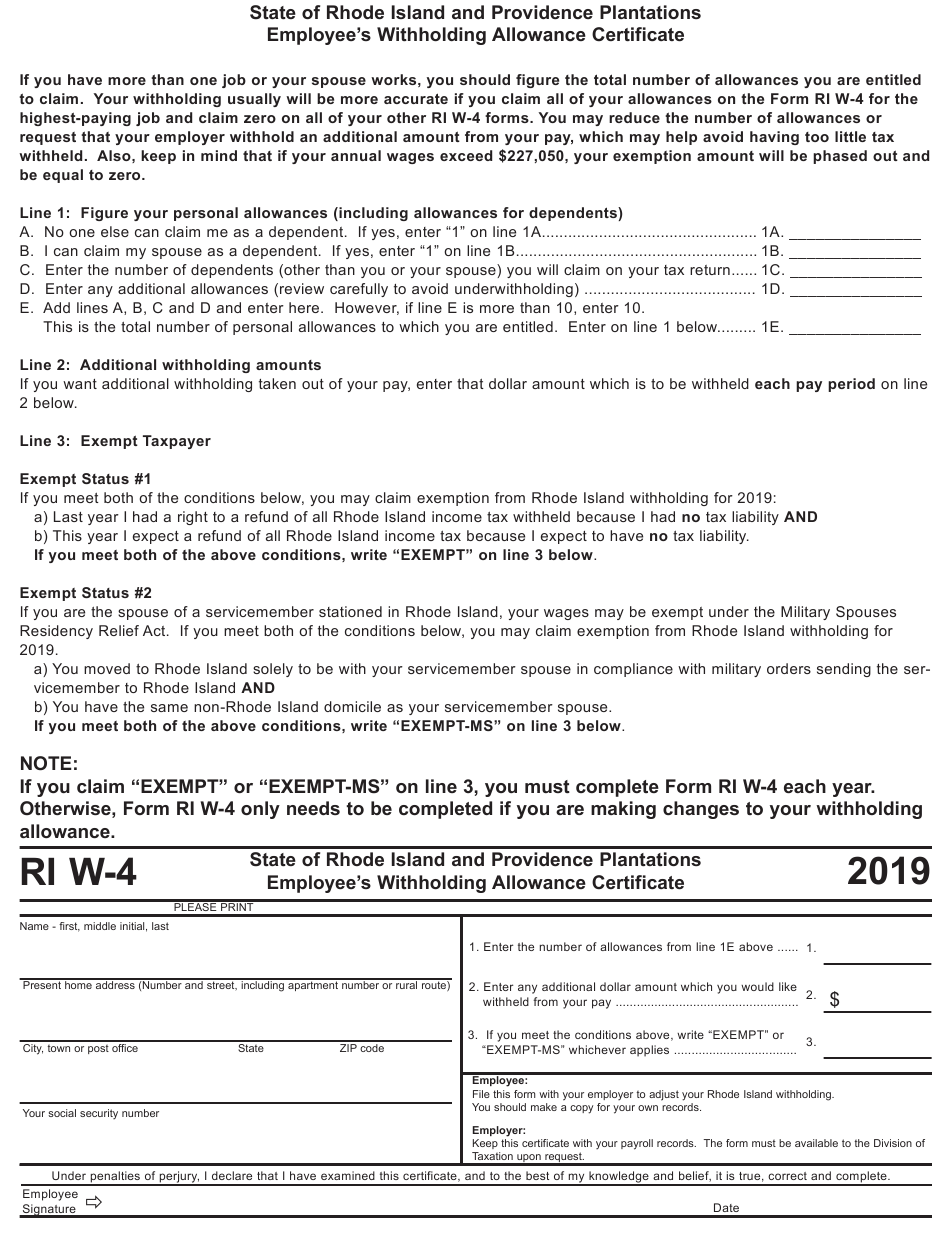

Source: www.dochub.com

Source: www.dochub.com

Iowa w 4 instructions Fill out & sign online DocHub, Centralized payroll is committed to meeting the expectations of state of iowa employees each pay period to receive a timely and accurate payment. If too little is withheld, you will generally owe tax when you file your tax return.

Source: www.studocu.com

Source: www.studocu.com

2022 Form W4 health Form W Department of the Treasury Internal, This is the actual federal withholding amount on your paycheck. First, in a multiyear plan.

Source: printableformsfree.com

Source: printableformsfree.com

Iowa Withholding Form 2023 Printable Forms Free Online, There will be two brackets in 2025 with a top rate of 4.82 percent and a single. Updated for 2024 (and the taxes you do in 2025), simply enter your tax information and adjust your.

:max_bytes(150000):strip_icc()/Screenshot2023-03-17at4.01.40PM-e9aa8d8ea87c496b906b8b35c7c8592c.png) Source: printableformsfree.com

Source: printableformsfree.com

2023 W4 Tax Form Printable Forms Free Online, On march 1, 2022, governor reynolds signed into law a tax reform bill which includes establishing a 3.9 flat income tax rate that will be phased in over four years. Do not claim more in allowances than necessary or you will not have enough tax withheld.

Source: www.formsbank.com

Source: www.formsbank.com

Fillable Form Ia W4 Centralized Employee Registry Reporting Form, Do not claim more in allowances than necessary or you will not have enough tax withheld. First, in a multiyear plan.

/cloudfront-us-east-1.images.arcpublishing.com/gray/G3VLSWIP5JKIZIFFFTTQNVKRQA.jpg) Source: www.dakotanewsnow.com

Source: www.dakotanewsnow.com

New Iowa license plate designs unveiled, If too little is withheld, you will generally owe tax when you file your tax return. The new form has updated the filing status and now.

Source: formspal.com

Source: formspal.com

Ia W 4 Form ≡ Fill Out Printable PDF Forms Online, Do not claim more in allowances than necessary or you will not have enough tax withheld. This is the actual federal withholding amount on your paycheck.

Source: cloqnichol.pages.dev

Source: cloqnichol.pages.dev

State Of Iowa W4 Form 2024 Adena Brunhilde, On march 1, 2022, governor reynolds signed into law a tax reform bill which includes establishing a 3.9 flat income tax rate that will be phased in over four years. You may find that you owe the state of iowa more tax when preparing your 2024 iowa tax return in early 2025.

Source: zoranawedyth.pages.dev

Source: zoranawedyth.pages.dev

Il State W4 2024 Bryna Sibylle, You may find that you owe the state of iowa more tax when preparing your 2024 iowa tax return in early 2025. In both 2024 and 2025, the highest rate will be eliminated, so in 2026 iowa will have a single rate possibly necessitating future adjustments.

Through Workday, State Of Iowa Employees Can Receive An.

Shift from allowances to allowance dollar amount;

Do Not Claim More In Allowances Than Necessary Or You Will Not Have Enough Tax Withheld.

You may find that you owe the state of iowa more tax when preparing your 2024 iowa tax return in early 2025.

2025