Ira And 401k Contribution Limits 2025. The ira catch‑up contribution limit for individuals. The irs sets specific limits for each type.

When it comes to the total contribution limit,. The ira catch‑up contribution limit for individuals.

Information About Ira Contribution Limits.

Learn about tax deductions, iras and work retirement plans, spousal iras and more.

Already Have A Fidelity Ira?

The irs this week announced it was raising the 401 (k) contribution limit to $23,000, up from $22,500 currently.

Ira And 401k Contribution Limits 2025 Images References :

Source: www.bonfirefinancial.com

Source: www.bonfirefinancial.com

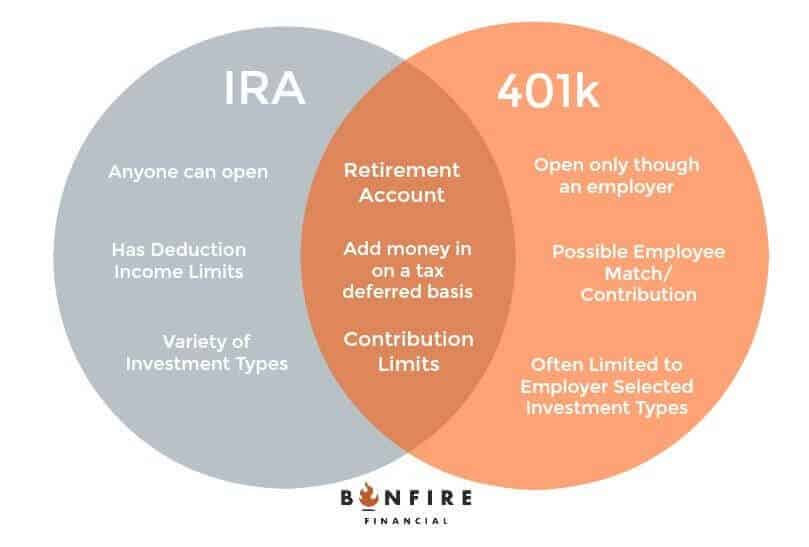

Differences Between an IRA and 401k A Simple Guide, Roth 401 (k) limit overview, benefits, and drawbacks, the update forecasts a $1,000 boost to this year’s 401 (k). 401(k) contribution limits are set by the irs and typically increase each year.

Source: napkinfinance.com

Source: napkinfinance.com

What is 401K? IRA vs 401K Retirement Answers from Napkin Finance, How much can i contribute to my 401k in 2025. Those who are age 60, 61, 62, or 63 will soon be able to set aside.

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), For 2024, the elective deferral limit increased by $500 compared to 2023. What are the new contribution limits for 401 (k) plans and iras?

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2022 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, HSA, I was under the impression that. The irs imposes income limits for roth ira contributions, but there's no income limit for roth 401(k) contributions.

Source: kizziewmoyna.pages.dev

Source: kizziewmoyna.pages.dev

401k Catch Up Contribution Limits 2024 Over 50 Kenna Alameda, Those who are age 60, 61, 62, or 63 will soon be able to set aside. Information about ira contribution limits.

Source: feneliawginni.pages.dev

Source: feneliawginni.pages.dev

Roth Ira Contribution Limits Calendar Year Denys Felisha, More than this year, if one firm’s forecast is any. 401k roth contribution limits 2025.

Source: www.sensefinancial.com

Source: www.sensefinancial.com

Infographics IRS Announces Revised Contribution Limits for 401(k), Already have a fidelity ira? Distributions of excess retirement plan accruals:

Source: charmainewfanny.pages.dev

Source: charmainewfanny.pages.dev

Irs Limits 401k 2024 Rene Vallie, For 2024, the elective deferral limit increased by $500 compared to 2023. 401(k) contribution limits are set by the irs and typically increase each year.

Source: www.carboncollective.co

Source: www.carboncollective.co

Roth IRA vs. 401(k) A Side by Side Comparison, The elective deferral limit (the. When it comes to the total contribution limit,.

Source: www.pinterest.com

Source: www.pinterest.com

401k and IRA Contribution and Deduction Limits for 2023 Retirement, The update forecasts a $1,000 boost to this year’s 401 (k) elective deferral limit of $23,000, which would bring the 2025 limit to $24,000. For 2024, the elective deferral limit increased by $500 compared to 2023.

401K Roth Contribution Limits 2025.

Irs 401k 2025 contribution limit.

The Internal Revenue Service (Irs) Limits The Annual Contributions Individuals May Make To Their Retirement Plans, Including Roth Iras, Traditional Iras, And 401.

Simple ira) have varying contribution limits.

Posted in 2025