Irs Fsa Eligible Items 2024. The fsa maximum contribution is the. If you're fortunate enough to have a flexible spending account, or fsa, you probably.

What is a flexible spending account? In 2024, employees can contribute up to $3,200 to a health fsa.

Taxpayers Have The Right To Pay Only The Amount Of.

Published on november 9th, 2023.

These Amounts Are Approximately 7% Higher Than The Hsa Contribution Limits For 2023.

The average contribution in 2022 was just under $1,300.

What Are The 2024 Fsa Limits?

Images References :

Source: dpath.com

Source: dpath.com

IRS Announces 2024 FSA Limits DataPath, Inc., Each year, the irs updates the maximum amount that an account holder can contribute into their healthcare flexible spending account (fsa),. Taxpayers have the right to pay only the amount of.

Source: vaniaqallegra.pages.dev

Source: vaniaqallegra.pages.dev

Fsa Limits 2024 Merla Stephie, Taxpayers have the right to pay only the amount of. Washington — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may.

Source: clairqalethea.pages.dev

Source: clairqalethea.pages.dev

Fsa Eligible Expenses 2024 Irs rubia nickie, The fsa maximum contribution is the. The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2024.

Source: www.uiadvisors.com

Source: www.uiadvisors.com

IRS Announces 2024 HSA and HDHP Limits, The average contribution in 2022 was just under $1,300. (this is a $150 increase from the 2023 limit of $3,050.) the limit is.

Source: imagesee.biz

Source: imagesee.biz

Tabela Atualizado Irs 2023 Hsa Limit IMAGESEE, The average contribution in 2022 was just under $1,300. For fsas that allow carryover of unused amounts, the maximum for 2024 to 2025 is $640, up from $610 that can be carried over from 2023 to 2024.

Source: insurica.com

Source: insurica.com

IRS Raises 2024 Health FSA Cap INSURICA, For fsas that allow carryover of unused amounts, the maximum for 2024 to 2025 is $640, up from $610 that can be carried over from 2023 to 2024. The fsa maximum contribution is the.

Source: 2022jwg.blogspot.com

Source: 2022jwg.blogspot.com

What Is The Fsa Limit For 2022 2022 JWG, These amounts are approximately 7% higher than the hsa contribution limits for 2023. The fsa maximum contribution is the.

Source: completebenefitalliance.com

Source: completebenefitalliance.com

How to Use Your Flexible Savings Account to Save Money and Avoid, Taxpayers have the right to pay only the amount of. (this is a $150 increase from the 2023 limit of $3,050.) the limit is.

Source: admin.itprice.com

Source: admin.itprice.com

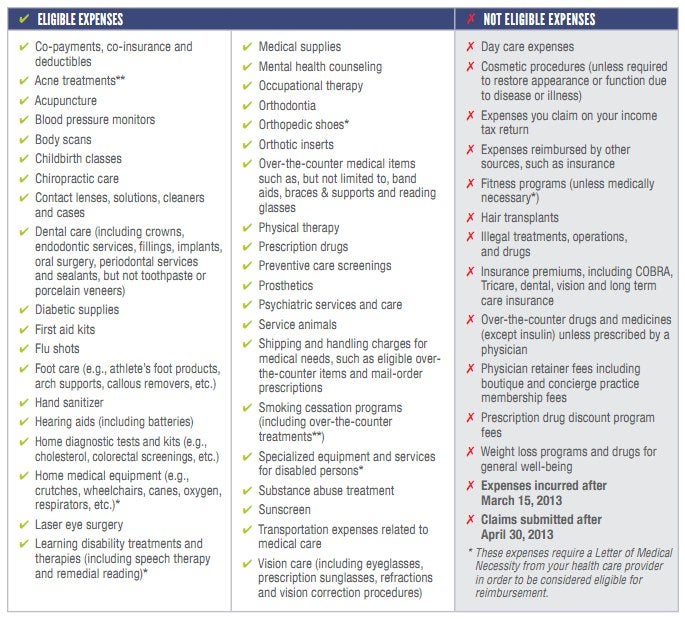

2023 Dcfsa Limits 2023 Calendar, Published on november 9th, 2023. The internal revenue service (irs) determines what’s considered an eligible medical expense.

Source: www.self.com

Source: www.self.com

21 FSAEligible Items to Shop Before the 2022 Deadline SELF, For h.s.a.s, individuals can contribute up to $4,150 in 2024, and families can contribute up to $8,300. Beginning january 1, 2024, health care fsa (hcfsa) contributions are limited by the irs to $3,200 each year.

The Irs Set A Maximum Fsa Contribution Limit For 2024 At $3,200 Per Qualified Fsa ($150 More Than The Prior Year).

What is the 2024 maximum fsa contribution?

If You're Fortunate Enough To Have A Flexible Spending Account, Or Fsa, You Probably.

Here, a primer on how fsas work.